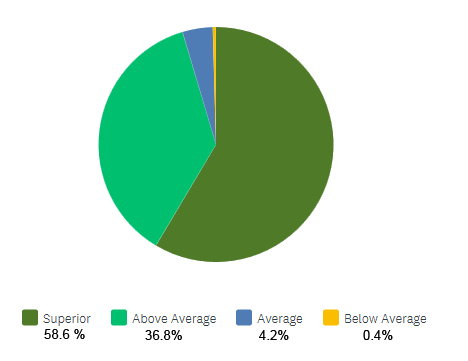

OVER 95% OF OUR AGENTS RATE OUR SERVICE

ABOVE AVERAGE

OVER 96% OF OUR CLIENTS WITH FLOOD LOSSES WERE SATISFIED WITH THEIR CLAIMS EXPERIENCE

In the short time since we began in October 2013 we have written over $100,000,000 of private flood insurance premiums. The Flood Insurance Agency's Private Market Flood program now provides over $4 billion dollars of flood insurance coverage for residential, habitational and commercial properties. A client applies for, or purchases a Private Market Flood policy every four to five minutes. A unique user visits our website every 52 seconds! That is a testimony to the public acceptance of our program as an alternative to FEMA flood insurance.

What will the premium be next year? Now you know! Private Market Flood offers a solution to ever-increasing annual flood insurance premiums: Rate-Lock. Rate-Lock allows policyholders to pay the same rate for two years (with one-year rate-lock) or three years with (two-year rate-lock).

Benefits of Rate-Lock:

Rate-Lock provides peace of mind for up to three policy cycles, preventing any surprises on future renewal bills.

Rate-Lock guarantees a policy renewal will be offered.

Rate-Lock is surprisingly affordable.

Rate-Lock provides you peace of mind at renewal, but it can also assist you in the sale of your home:

All Private Market Flood policies are assignable to a new buyer. The new owners are also entitled to the Rate-Lock premium which means potential buyers won't be turned off due to the uncertainly of future flood insurance premiums!

Rate-Lock options are available for new estimates and most renewals.